The What If Only One Spouse Is Filing Bankruptcy Diaries

Kevin, South Carolina "I had been pleasantly shocked While using the format plus the non-judgmental way this program was introduced."

That will depend on the sort of bankruptcy you qualify for. Having a Chapter 7 bankruptcy, your property are going to be sold (besides Most likely your own home and car), as well as your creditors is going to be compensated off with the proceeds.

Extreme Home Ownership: If one particular spouse owns sizeable independent property, joint filing might not sufficiently go over all assets with exemptions, and personal filing might be additional protecting for your non-filing spouse’s assets.

You’ve also got to deliver evidence that you submitted your taxes, each condition and federal, for the final four a long time. They're a couple of of the necessities that needs to be achieved ahead of filing Chapter 13 or 7 bankruptcy.

A joint bankruptcy will be mirrored on both equally spouses’ credit rating reviews and can have a harmful effect on their credit score scores.

This could certainly probably set shared assets in danger or involve the non-filing spouse to order out the debtor’s share.

Navigating economical struggles might be difficult, Primarily when considering bankruptcy when married.

The attorney or law company you might be making contact with will not be needed to, and should opt for to not, take you being a consumer. The net just isn't always secure and emails despatched by This page may be intercepted or read through by third parties. Thanks.

To file Chapter thirteen bankruptcy you should have common revenue that’s superior ample to cover your regular monthly living bills plus your month-to-month system payment. Home loan arrears, skipped car payments, non-dischargeable tax debts, and back again spousal or baby assistance payments important site might be compensated off inside the system.

The automatic keep guards filers from creditor assortment steps though their situation is pending. The co-debtor remain shields the non-filing spouse from collections, even When they are jointly liable to the financial debt. Consequently creditors simply cannot attempt to collect in the non-filing spouse on joint debts.

Other elements contain the filer’s earlier bankruptcy background and the amount of debt. It is actually view it very important to refer to with a lawyer to navigate the complexities on the signifies examination and also to ensure the chosen bankruptcy chapter aligns with the filer’s financial fact.

With this particular facts, you can determine exempt home beneath my explanation New Jersey rules and carry on with filing the requisite forms at a brand new Jersey district bankruptcy court. It’s essential to the filing to generally be complete and discover this truthful, as any discrepancy can possibility the entire bankruptcy petition.

Chapter 13. It's much easier to qualify for Chapter thirteen than for Chapter 7. Instead of erasing your credit card debt, this kind of filing reorganizes your spending. You'll reach keep your belongings, even so the court will get a pop over to this web-site price range that you should continue to exist, that will involve a regular payment program for your personal debts.

The non-filing spouse should still be answerable for joint debts. Creditors can continue to go after the non-filing spouse for personal debt payments, which could negate a lot of the economical aid the filing spouse obtains.

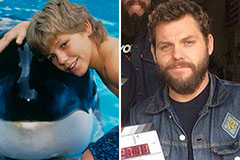

Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Mike Vitar Then & Now!

Mike Vitar Then & Now! Kelly Le Brock Then & Now!

Kelly Le Brock Then & Now! Lisa Whelchel Then & Now!

Lisa Whelchel Then & Now! Erika Eleniak Then & Now!

Erika Eleniak Then & Now!